Tampia Gold Mine (Narembeen)

Location & Project History

The Tampia gold mine was acquired via the takeover of Explaurum Limited (ASX:EXU) by Ramelius in late 2018/early 2019.

The project is located 12km south-east of the town of Narembeen in the Western Australia wheatbelt and 250km east of Perth. In early 2021, Ramelius purchased the 10% minority interest in the project and additionally acquired the freehold farmland that the project is located on. Mining commenced in May 2021 and ore processing commenced in July 2021. Mining operations were completed in the June 2023 Quarter.

The deposit is 148km by sealed roads from the Edna May gold mine. The deposit is located on granted mining lease M70/816. The total project area covers 327km², comprising two mining leases and nine exploration licences.

Geology and Mineralisation

The deposit is hosted within a highly metamorphosed mafic gneiss unit. The mafic gneiss contains migmatitic feldspar-biotite-quartz banding within an overall synformal structural trend. It is also intruded by granitoid dykes and sills.

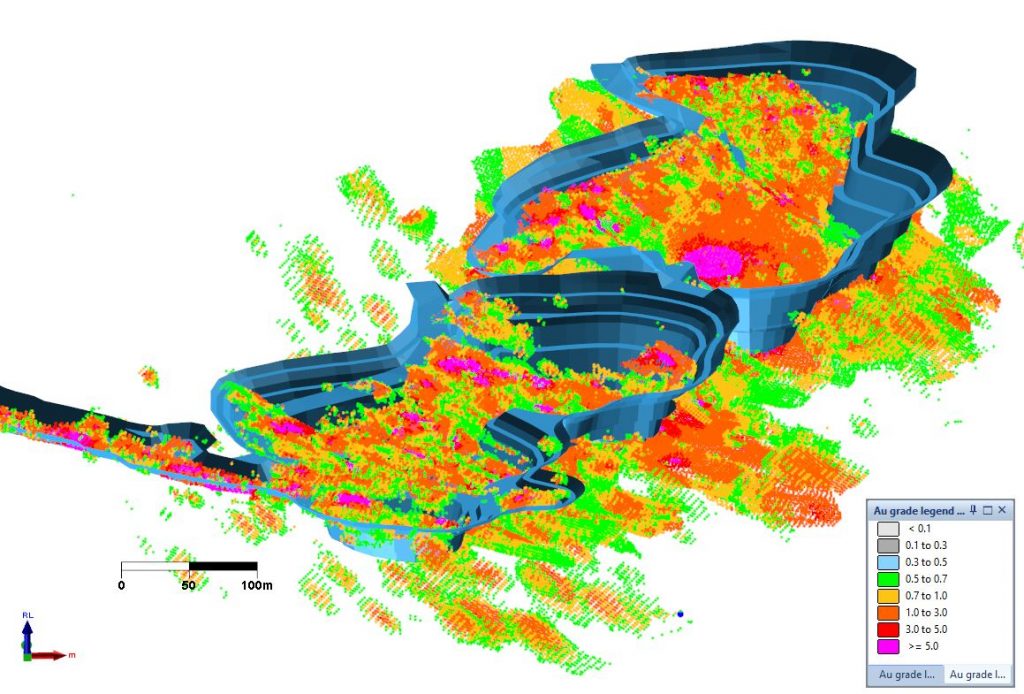

Mineralisation occurs as shallow dipping stacked tabular lodes within the mafic gneiss. These lodes are approximately parallel to the overall mafic gneiss unit geometry, banding and synformal structure. Granitic sills are intruded sub-parallel to lodes and are late and unmineralised.

Gold mineralisation is associated with hornblende-biotite-pyroxene-plagioclase alteration and disseminated arsenopyrite-pyrrhotite-chalcopyrite sulphides. Gold mineralisation correlates strongly with Arsenic grade and fresh ore is partially refractory. Weathering is relatively shallow.

Mineralisation currently extends over a strike length of 700m. The tabular lodes are between 2 and 20m thick with a drilled down-dip extent of around 350m. Between 1 and 3 economic lodes generally occur per drill section.

The deposit is augmented by the small Mace paleochannel deposit. The deposit hosts re-mobilised, frequently nuggetty gold, in a 10 to 50m wide, 2 to 6m thick paleochannel zone occurring 10-15m below surface. The channel starts over the main Tampia deposit and extends north-west for 550m. Gold is hosted by clays and the base of the channel marked by semi-rounded quartz fragments. While not large, the Mace deposit represents a low-strip, free milling, high-margin ore source.

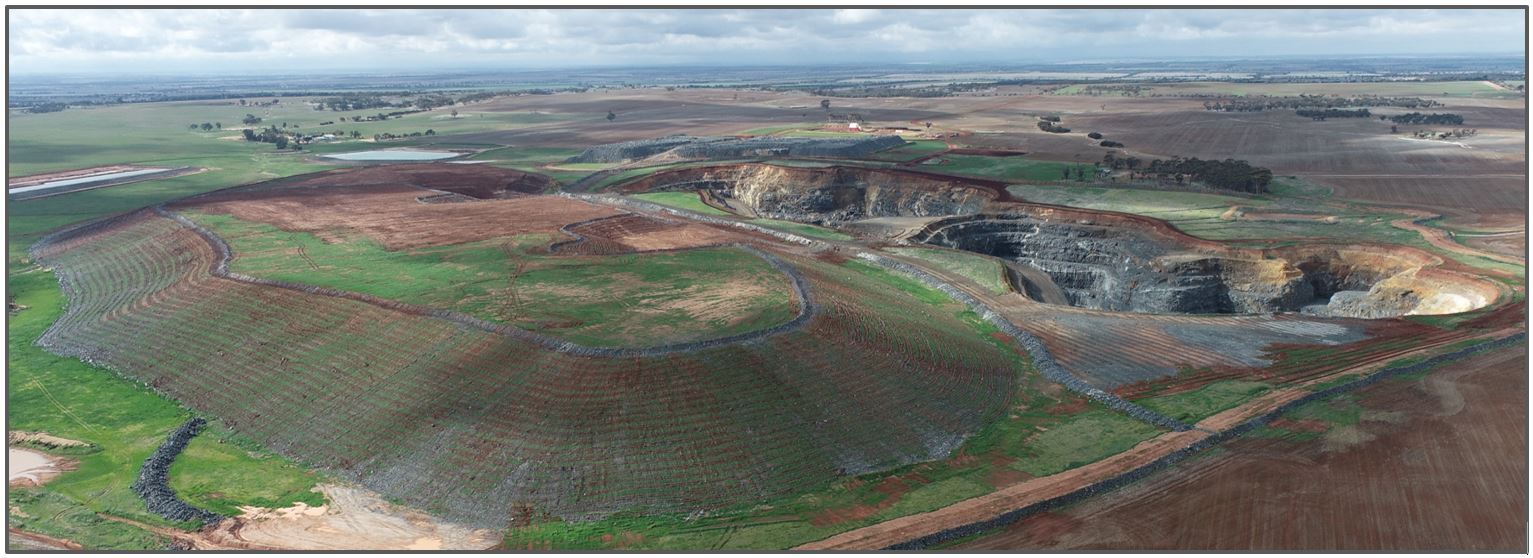

Progressive Rehabilitation at Tampia

Mineral Resource and Ore Reserve

The latest Mineral Resource (ROM & LG stocks) stood at 770,000t @0.9 g/t for 23,000 oz (Refer 2 September 2024 ASX Release).

The latest Ore Reserve (ROM stocks) stood at 770,000t @0.9 g/t for 23,000 oz (Refer 2 September 2024 ASX Release).

The project financials are calculated on Ore Reserves only and are shown on a 100% basis.

Metallurgy

Ore processing is carried out at the Edna May mill. The original processing method incorporated gravity recovery, flotation, ultra-fine grinding, and enhanced leaching to treat the more refractory elements of the ore, with carbon-in-leach (CIL) being used to treat the flotation and enhanced leach tailings product. Additional test work was conducted on spatially representative ore samples, which included the more refractory elements of the ore. This additional test work demonstrated that at a reduced grind size (125µm), the standard gravity and CIL process is equally effective, if not superior, to the initial proposed flotation and ultra-fine grind processing.

Minor modifications have now been completed at the Edna May mill to allow for the finer grind size. These include upgrades to secondary crushing & screening, cyclone configuration, liquid oxygen and the leach feed thickener.

Tampia Resource model and open pit design